Oxford Innovation EIS Growth Fund

Open for Investment

An opportunity to invest in the next generation of innovative, high-growth UK science and technology companies, underpinned by the extensive experience OION, the UK's most active angel network* and with the potential to achieve significant tax-free capital gains.

Next Close: 30 April 2025** |  |

Minimum investment: £10,000 |  Funds invested within 12 - 18 months of the Close date |

Maximum investment: Unlimited |  Highly regarded Investment Committee |

Each investor receives portfolio of 6 - 12 innovative companies |  Managed by Oxford Innovation Finance |

Large source of qualified potential investments |  Fund Custodian: Kin Capital Partners LLP |

Co-investment alongside our OION angel network or VC Funds |  Support for companies from Oxford Innovation & OION community |

Investing profoundly in the industry of disruptive science and the next generation of technology, the Oxford Innovation EIS Growth Fund provides a gateway to a diverse selection of high quality early-stage companies developing solutions to the challenges of our future.

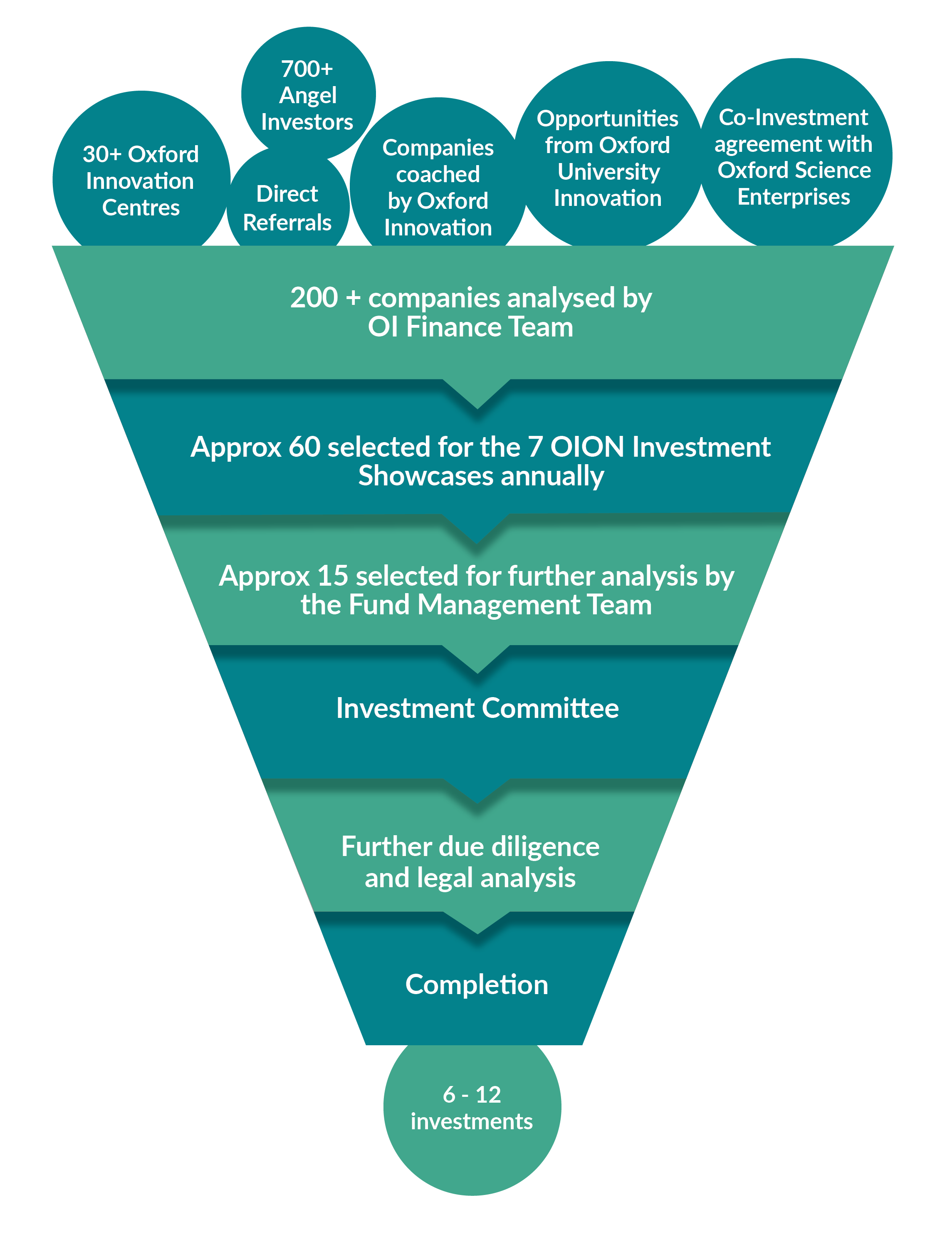

Our unique approach makes use of an extensive network of entrepreneurs, angel investors, sector experts and business coaches to source and select the best investments for the Fund, helping them to realise their growth and maximising the opportunity for a profitable exit.

|

Network Expertise

The Fund draws upon Oxford Innovation’s extensive network of technology talent and opportunities. The advantage of this is:

- We find the most promising opportunities from a wide spanning network providing a quality flow of potential deals.

- We provide access to opportunities that have been assessed by individuals with a significant amount of market knowledge and experience.

- We are able to add vital knowledge, experience and contacts to help grow the companies using the Oxford Innovation network, including from sister divisions Oxford Innovation Space and Oxford Innovation Advice.

Oxford Innovation EIS Growth Fund portfolio companies

|  |  |

|  |  |

|  | |

|  | |

| ||

|  |  |

|  |  |

|  |  |

|  | |

|

What our portfolio companies say about us

The documents for the Fund can be accessed via the button below, they will become available for download following completion of the required information.

*According to data compiled by Beauhurst.

**The Manager retains the right to change the Closing Date and/or undertake Interim Closings at its discretion, subject to the availability of funds and suitable investments. Funds raised in each Close will be invested alongside those subscribed in prior Closes and in subsequent Closes. It is intended that each Investors subscription will be invested in a portfolio of 6-12 EIS Qualifying investments within 12-18 months of each fundraising tranche Close.

RISK WARNING

Investments in the Oxford Innovation EIS Growth Fund (the Fund) place your capital at risk. The Fund Manager, Oxford Investment Opportunity Network Limited (trading as Oxford Innovation Finance), does not provide investment, tax or legal advice and recommends that you seek professional advice if you are considering investing in the Fund. You may lose part or all of the amount you invest in the Fund. The Fund invests in unquoted shares in small companies. The value of these shares can be volatile, and the shares are often difficult to sell. The tax reliefs associated with the investments depend on the individual circumstances of each investor and may be subject to change. Past performance is not a reliable indicator of future results. The Fund Manager’s forecasts and performance targets cannot accurately predict how investments will perform. Your attention is drawn to the section of the Fund’s Information Memorandum headed “Risks”, which should be reviewed in full.